Week 12 (Dec 15th) LAST CLASS

Review – what is something you learned this term in Budgeting class?……

- Communication and attitude regarding budgeting. In our first classes we discussed how we can change our “thinking about money”.

- In a survey by Ally Bank, 36 percent of couples reported that money was the biggest source of stress in their relationship. Luckily, it is possible for partners to come together.May 12, 2020

- “I’ve counseled more than 500 couples—and this is the No. 1 money mistake that ruins relationships.”Published Tue, May 7 2019 Amanda Clayman, Contributor.

https://www.cnbc.com/2015/02/04/money-is-the-leading-cause-of-stress-in-relationships.html

What’s your thoughts? Why do you think people argue about money in a relationship? How can you make it fair and equal?

Hypothetical scenario 5 years from now for our friend Jim-Bob future example:

JimBob income: 2000 /month

Lisa income 3000/month

| Income | $ | Combined Expense | $ | |

| JimBob | 2000 | Rent | 1200 | |

| Lisa | 3000 | TV & int & Cellphone | 300 | |

| Electric | 100 | |||

| Car (gas & Ins) | 250 | |||

| Food | 900 | |||

| Fun (movies, concerts etc). | 250 | |||

| Tot: | $_5000____ | Tot: | $_3000_/2= 1500_ |

How much leftover will they have together? __2000____________

How much will they have left over individually if they don’t “share the income”? JimBob_2000-1500= 500______ Lisa _3000-1500= _1500_____

Is it fair for them to share the income and all the bills in the middle? What’s your thoughts? What would you prefer?

Final Kahoot: Anders will provide the link.

————————————————————————————————-

Week 11 , Dec 8th

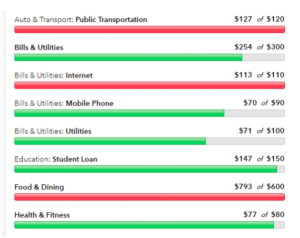

Going over Jim Bob’s budget for month of December:

It’s been a pretty good to start the month. JB has spent some money on gifts this year already, but he’s not sure he’ll have enough money…. What do you think?

Lets list his expenses vs income…..and please play around with this scenario for your own budget. Planning is KEY

Income: JimBob is receiving SSI: 783.00/month, In addition JB is walking dogs in his neighborhood, he makes on average $75 / week.

Expenses: He has an apt together w his brother. They share most costs these are all split 50/50: Rent $600, TV&Int net $170, Electric $50, garbage $ 40, Food $675,

(A) JB spends his own money on Netflix $10, Amazon Prime $10, Gym $30, credit card $50 (remember the furniture set, ugh), Cellphone $60.

(B) JB changed his routine and now spends about $10/week on lunch when he goes out to spend time with his friends (they still go to Subway). 10/week (4 weeks a month). He cut out coffee/chocolate completely. Cost/Month? 10×4 = 40

(C)**** Extra this month: Xmas tree: $ 50.00 , And he got a gift for his brother (a skateboard) for $95.00

What is his total expenses for the month? __1087.50__________

What can he change and save money on? __Amazon account?, Share the NETFLIX account, Food cost (SNAP account), Freeze gym card? ,

| Income | $ | Expense | $ | individual exp. |

| SSI | 783.00 | Rent | 300 | (A)_160_____ |

| Dog Walking | 300.00 | TV & int | 85 | (B)__40_____ |

| Leftover (last month): | 280.00 | Electric | 25 | Gift: 95.00 Skateboard |

| Garbage | 20 | |||

| Food | 337.50 | |||

| Extra: Xmas tree | 25.00 | |||

| Tot: | $1363.00 | Tot: | $792.50 | Tot:295.00 |

Total expenses (split and individual): = 792.50+295.00=__1087.50_______

| Income: 1363.00 | – expenses 1087.50 | = total leftovers 275.50 |

| 1363.00-1087.50 = 275.50 |

Review of Credit card vs Debit card.

https://www.youtube.com/watch?v=8LZqEoEyk60

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)

- credit card charges interest (%), charges hefty late fees,

Kahoots quiz: Anders present the code.

End activity: *****If time: play this independently. *****

Budgeting Game “The Pay Off” (choose the “solo player” tab and see where the adventure will take you).

https://payoff.practicalmoneyskills.com/

—————————————————————————————————–

12/1 December!!! Week 10

Review of last week. What was the deal of the year for Cyber Monday (yesterday)? Did you buy anything..?

Today:

Impulse shopping

“An impulse purchase or impulse buying is an unplanned decision to buy a product or service, made just before a purchase. One who tends to make such purchases is referred to as an impulse purchaser, impulse buyer, or compulsive buyer.

5 tricks stores use to get you to shop more. (we found – Red signs flashing, Time, Festive music, 0.99 pricing).

How do you avoid it? Some things we found: create a list so you don’t shope for random items, wait 30 days and see if you still want to buy it, do the math – how many hours must you work to make this amount of money, create a category in your budget “splurge/shop”.

(Short video)

https://www.youtube.com/watch?v=eIglFmyKgRw&feature=emb_logo

(long video, for later)

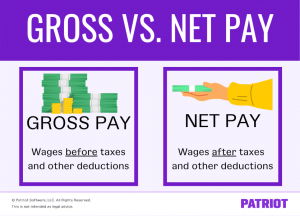

Net vs Gross income.

The 50/30/20 rule

The 50–30–20 rule is: 50% of your income for needs, like housing and bills; 30% for wants, like dining or entertainment; and 20% for saving goals, emergencies, paying off debt or saving for retirement

Kahoot quiz: Anders Share the screen.

Link: – log into: KAHOT IT. Enter the code: ______________

Story: JimBob.

He had how much left last month? Total of $445.00 or (148.33 per family member for gifts).

He did shop a little over the weekend ; he got his mother a jacket (price 75.00) and his Father a new chess set (price 89.00).

How much does he have left to spend?

| Person and budget. | item & cost | Leftover amount | |

| Dad (148.33) | Chess set 89.00 | 59.33 | |

| Mom (148.33) | Jacket 75.00 | 73.33 | |

| Sibling (148.33) | – | 148.33 | |

| total 445.00 | 280.99 |

————————————————————————————————–

11/24 Week 9

Review of last week.

A little reminder of what the class is about, Young adults budgeting:

https://www.cnbc.com/2020/03/02/top-strategies-for-young-adults-to-find-financial-success.html (go to “How to make a budget” 2:26min long video).

In just 3 days it is “the sale of the year” (Black Friday). Though as we discussed earlier there are many stores that have already started their sales.

Best deals in History of Black-Friday

https://www.joinhoney.com/blog/article/best-black-friday-deals

How good are these deals? What do you think will be the best deal this year?

When on a budget and saving money there are things you can do to make additional money. Think about it – Is there anything you can sell that you’re no longer using? I had lots of extra tools and realized I could sell some of it. (I had 3 saws, 3 axes, 3 ladders… I had no use for them all and had a garage sale over the summer). My kids sold LEGO’s and a ping-pong table.

Story problem for JimBob: So, last week we figured out what the amount is for JimBob to spend on gifts for his family this X-mas.

He has $ _275.00____ to spend. That equals $ _91.66____ per person (his 3 family members).

JimBob is a lucky young man. This month he helped his neighbor KEN sell items on Craigslist. His deal was, if you help me sell it – you get to keep half of the money. JimBob carried items to his garage, cleaned them, took photos and posted on Craigslist.

It was a success and he sold it all last weekend: this is what he sold.

| Item | Price $ |

| Microwave | 20 |

| Small kitchen table, with 2 chairs | 80 |

| Recliner chair (leather) | 90 |

| Bike (Specialized mountain-bike) | 150 |

How much did he sell items for? __340.00____

How much did JimBob get to keep? __170.00____

How much money does he have to spend right now? From last week: __275.00___ + money from Craigslist-sale :_170.00_____

Total:_$_445.00______ …If spending it all on his 3 family members:445/3 = 148.33

Reminder – don’t overspend even though the deals from Black Friday may be tempting.

11/17 Week 8

Review last week.

Kahoot on zoom. Watch video and then we’ll take a little practice quiz (only to practice how it works).

Minimize your window so you have room for a blank window and follow the info from Anders screen share.

Next part is ….

What is Black Friday?

https://www.youtube.com/watch?v=6GX7l–iOBU

“Back in the day’s – Black Friday”

Next week we’ll do some more fun research on finding deals on Black Friday.

JimBob story problem: (continued from last week).

Total income: $1’183.00

Total expense: 1047.50

How much money does he have left to buy gifts for? 1183 – 1047.50 = $ 135.50

How much if he gave up half of his coffee drinks and half of his lunch-eat-out?

Total individual cost: 280 / 2 = $140.00

Total if half of lunch and coffee: 140 + 135 = $275.00

What shall he buy? (Mother , brother, father) He can spend __$91.66___ $ per person (275/3= 91.66).

————————————————————————–

11/10 WEEK 7

Review the last class – the cost of interest: was it surprising….? A lot of money to be saved , and/or made depending on if you can stick to a budget.

Next week we’ll go over the idea of BlackFriday and see what deals we can find. However, it has already started for some stores. How do you find the best deals? What search engines do you use.?

video:

https://www.youtube.com/watch?v=EMFjLwOJIUA&feature=emb_logo

https://www.shopify.com/blog/7068398-10-best-comparison-shopping-engines-to-increase-ecommerce-sales

17 top price comparison websites

- Google Shopping

- PriceGrabber

- Shopping.com

- Shopzilla

- Become

- Bing Shopping Campaigns

- Pronto

- Bizrate

- Amazon Sponsored Products

- Camelcamelcamel

- ShopMania

- BuyVia

- ShopSavvy

- Yahoo Shopping

- Pricepirates

- MyShopping Datafeed

- Idealo

What is the best price you can find for e.g. CAMERA Canon eos 250d ? Pick a number and search through that website….did it work? what was the price?

Next activity is to solve individually or work as a group?

Jim Bob’s budget for month of October:

JB wants to spend some money on gifts this year, but he’s not sure hell have enough money…. What do you think?

Lets list his expenses vs income…..and please play around with this scenario for your own budget. Planning is KEY

JimBob is receiving SSI, he has an apt together w his brother. They share most costs these are all split 50/50: Rent $600, TV&Int net $170, Electric $50, garbage $ 40, Food $675,

(A) JB spends his own money on Netflix $10, Amazon $10, Gym $30, (credit card $50, remember the furniture set, ugh), Cellphone $60.

(B) JB usually spends about $6/day on lunch when he goes out to spend time with his friends (they usually go to Subway). 5days/week (4 weeks a month).

In addition to his SSI JB is walking dogs in his neighborhood, he makes on average $75 / week.

He has also helped with leaf raking and made another $100 doing that.

What is his total expenses for the month?

What can he change and save money on?

How much money will he have to spend on gifts?

What shall he buy? (He wants to get gifts for mother, brother and father).

| Income | $ | Expense | $ | individual exp. |

| SSI | 783.00 | Rent | 300 | 160 (A) |

| Dog Walking | 300.00 | TV & int | 85 | 120 (B) |

| Raking Leafs | 100 | Electric | 25 | |

| Garbage | 20 | |||

| Food | 337.50 | |||

| Tot: | $1’183.00 | Tot: | 1047.50 |

—————————————————————————————————-

11/3 WEEK 6

Review of interest made $$$$!!

The cost of Credit card debt: 20 sec into clip

https://www.youtube.com/watch?v=GylVCCtL-tA

A lot of information. Do you believe it’s true ? Could YOU make that much $$ if that money was invested instead…? Discuss as a group.

The credit card calculator – lets play around with some numbers. Fill in the blank using the tool below:

https://www.bankrate.com/calculators/credit-cards/credit-card-payoff-calculator.aspx

| Balance | Interest rate % | Payment / month | months for payoff | total cost of the loan: |

| 3000 | 15 | 200 | 17 | 3343 |

| 2000 | 20 | 42 | 96 | 4010 |

Remember the activity we did for Jim Bob last week.

Let’s do an activity with Jim Bob but simplify the math.

Jim bob bought a classy “fake leather” Furniture set on “sale” and put it all on his new credit card.

The total cost was $2000.00 and he’s plan is to at the end of each year pay $500.00 (he thinks it’s paid off in 4 years by doing this). However; his credit card interest is 20% (no additional fees). How much will he still owe after 4 years? (We’re simplifying the math to do the math once per year).

| Year | Total owed | Interest 20% | Paid off amount | How much he actually still owe |

| 1 | 2000 | 1.2 x 2000 = 2400 | 500 | 1900 |

| 2 | 1900 | 1.2 x 1900 = 2280 | 500 | 1780 |

| 3 | 1780 | 1.2x 1780= 2136 | 500 | 1636 |

| 4 | 1636 | 1.2x 1636= 1963.2 | 500 | 1463.2 |

It is very important to know how to calculate these money problems. There are many online calculators that are excellent tools to help with these at times complicated problems.

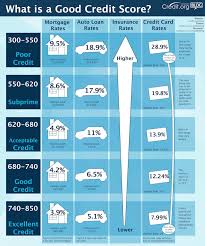

The video we saw earlier talked about credit scores? Why is it important to have a credit score?

Homework: Play around with the above example of JimBobs furniture set ($2000.00) if his credit score instead gave him an interest rate of 10%. How much would he still owe at the end of 4 years? (He’s still paying 500/year).

10/27 Week 5

Review of the “best APPS” for budgeting (and how they can help you with goals): MINT

Intro to BANK accounts (& Bank vs Credit union...)

Read the info on the website (below).

https://www.investopedia.com/guide-to-financial-literacy-4800530

Think about these questions:

Why would I want a credit union rather than a traditional bank?

What surprised you about the article/information?

Fun numbers game for JobBob’s budget:

How much money could JimBob make in interest over 3 years if you had a “high yield savings account with 6% interest compared to his current savings account” ? Right now he has a WellsFargo savings account with $ 5000.00 in it and he get’s 0.1% interest.

| YEAR | 1 | 2 | 3 |

| WellsFargo 0.1% int.

5000 |

|||

| HighYield 6%int

5000 |

|||

This is similar to a CD. what are the differences?

What is the highest CD interest rate you can find in today’s market?

10/20 Week 4

Review of last class – psychology of budgeting…

Budgeting Software

https://www.youtube.com/watch?list=PLlkSCGl6IAvCDidiUh0Sk3NXrtNTwbr2u&v=eQso4hoKJuk

Directions: There are many online products to help you with tracking your spending and budgeting your money. But which one is the best? Please work with a partner to research online budgeting software. Complete the graphic organizer below.

HINT: An easy way to find the info to learn about these apps is using the “nerdwallet” link below, or just google-search the info. You’ll often find out that other people have done some of the work for you.

https://www.nerdwallet.com/blog/finance/budgeting-saving-tools/

Do you know of/can you recommend some other apps?

Product 1: Mint: https://www.mint.com/

| Brief Description of Software: see

|

Cost: Free | |

| Pros: Automatically syncing the spendings, Can be glitchy | Cons: Must link bank account | |

| Your Opinion:

Group – it is still a good choice, Cool feature of giving alarm when hitting a certain preset maximum spending threshold

|

||

Product 2: You Need A Budget: https://www.youneedabudget.com/

| Brief Description of Software | Cost: Free trial , but after $12 months it cost 12/month | |

| Pros: | Cons: | |

| Your Opinion:

|

||

Product 3: BudgetSimple: https://www.budgetsimple.com/

| Brief Description of Software | Cost: DK | |

| Pros: | Cons: no longer in use | |

| Your Opinion:

Website has deleted the data. It is no longer in service. “They’re not kidding when they’re saying it’s simple, it so simple you can’t do anything with it”

|

||

Product 4: Money Point:

| Brief Description of Software: | Cost: Free | |

| Pros: Existing data can be imported quickly. No need to sync to bank. | Cons: no mobile version/app, any/all data must be entered manually. | |

| Your Opinion:

Sadira likes it 🙂

|

||

Product 5:

| Brief Description of Software | Cost: | |

| Pros: | Cons: | |

| Your Opinion:

|

||

Your Reaction: Please answer each question honestly:

1.What are some advantages of using budgeting software to help you track your money?

2What are some disadvantages of using budgeting software to help you track your money?

3.Would you use budgeting software to help you track your money?

4. Today, you researched several budgeting software applications. Which one did you like best? Why?

10/13

Review from last class 50/30/20 and want’s vs needs

https://www.nerdwallet.com/article/finance/budget-checklist-monthly-budget

Psychology of BUDGETING.

Video:

https://www.cnbc.com/2019/05/06/ramit-sethi-budgets-are-pointless-heres-what-to-do-instead.html

Article: The Secret to Budgeting Successfully, From Jeremy Vohwinkle

It’s All in the Attitude, Dude!

Have you ever attempted to budget and given up in frustration or discouragement? If you can figure out the reason your budgeting attempt failed, you’ll be able to institute a rewarding, successful budget and stick to it. Think about it. What really determines whether budgeting works for you?

One of the top reasons, if not THE top reason, so many people fail at budgeting is attitude. If you think of it as a penny-pinching sacrifice instead of a means for achieving your financial goals and dreams, how long are you likely to stick with it? It’s like the difference between going on a diet and eating healthily. One is negative and restrictive; the other is positive and allows you to indulge now and then and still achieve your goals.

To increase your chances of success, work on your attitude first.

Many people refuse to budget because of budgeting’s negative connotation. If you’re one of them, try thinking of it as a “spending plan” instead of a “budget.” Once you’ve attempted to budget and failed, the bad feelings associated with any type of failure can keep you from trying again. Don’t give up!

Why does budgeting matter? Money is a tool that enables you to reach your goals in life, but until you know where your money goes, you can’t make conscious decisions about how to use this tool effectively. A budget shows you exactly where your money goes and provides a spending plan that lets you save for the things that are important to you: a new house, a new car, a comfortable retirement, a college education, travel, or whatever your particular goals and dreams happen to be.

There are several universal budgeting concepts that every successful budget will include, but one of the most important features of a successful budget is customization to your needs. Don’t try to force your lifestyle and personal situation into a generic, one-size-fits-all budget. If a simpler approach makes it easier to stay committed, then go for simplicity. If you stick with a realistic, effective budget long enough, the rewards will keep you motivated; in the meantime, do whatever it takes to keep yourself going.

One important aspect of a successful, long-term relationship is working towards common goals, and a budget is a means of achieving them. Couples who can’t come to an agreement about savings towards common goals should sit down and talk calmly and rationally and come to a compromise to resolve this disconnect in their relationship.

It’s okay to have individual goals that the other person doesn’t share, and to provide for a way for those goals to be met, but it’s critical to have basic common financial goals that both people in the relationship agree to and are motivated to work towards. If you can’t agree about saving towards those goals, you’re going to be at cross-purposes that are going to be a cause of ongoing conflict. A budget centered around conflict and resentment is a budget doomed for failure.

If you still can’t figure out why your budget isn’t working, consider the psychological factors at work. What does money mean to you? Do you use it for reasons other than its obvious purpose? Do you use it as a self-esteem booster, to make yourself feel worthwhile? Do you enjoy the heady rush of making a new purchase? Do you use it as a sign of power or control in a relationship?

There are a number of good books about the psychological aspects of money that can help you spot these factors and help you work with them. See The Psychology of Spending Money.

If you jump into budgeting without a positive attitude about it, chances are high that you’ll give up before you’ve seen the difference a budget or spending plan can make in your life. The secret is to work on your attitude first.

From: http://financialplan.about.com/cs/budgeting/a/SecretBudget.htm

Directions: Please answer the following questions:

- How does your attitude affect your budget?

- Does calling a budget a spending plan help? Why or why not?

- Why does budgeting matter?

- The article suggests that a successful budget will be customized to fit your needs. What does this mean?

- Does having a goal help your budget? Why?

10/6/20

Students shared a recent purchase and decided if it was a want or need. Sometimes it’s both.

Want – don’t need but improves your life, would be a minor inconvenience if you didn’t have it

Need – Something you can’t live without or would greatly inconvenience you

https://www.youtube.com/watch?reload=9&v=9TpnG9sFWCw

Watch the video below to find out more about the 50, 30, 20 %-rule:

Work on Assignment: Want vs Needs (where does it go?) and Questions for the 50, 30, 20 rule.

Questions:

What is the difference between Gross vs Net income.? Gross is pre tax and net is after tax

What is the 50, 30 20 rule? multiple choice : A specific budget , and idea of what % of your income you should spend on expenses?

What % should you spend on WANTS? 20, 30, or 50.

List at least 3 examples of “spendings” that go into each category:

50%________________

30%________________

20%________________

What category will these “spendings” go into?

Video-game, rent, birthday gift for family member, music concert, retirement, cellphone, vacation, electric bill, emergencies, date-night, …..

Next week we will practice the math of the 20/30/50 rule. For students in advance budgeting please have online banking or your banking app installed. Please have your passwords, but you will not share personal financial information.

9/29

First day of class and we shared what we like to spend money on.

The groups were split in two depending on income and budgeting level.

Real Life Budgeting:

We shared our jobs, income and bills we pay.

Students then talked about the topics they want to learn about:

Online banking, paying bills online, avoiding bank fees, bouncing a check, how to write a check, credit vs, debit, credit scores, and students thought about what larger item they would like to save for.