12/1/21: Paper Snowflakes & Cinnamon Cut- Out Ornaments

These snowflakes were so much fun to make and are so beautiful! The Cinnamon ornaments are baked and ready for you to take home next class. Wow! They smell amazing!

11/24/21: No Class Prep For Thanksgiving Luncheon

11/17/21: Burlap Banners

We used some scrap burlap ribbon that we got at MECCA last week to make our burlap banners. The video below has very good description of how to make one of these banners using materials that would be easy to find. Also, you don’t have to have a glue gun, this banner can be made with school glue or mod-podge.

11/10/21: Field Trip To Oregon Art Supply & MECCA (Materials Exchange Center For Community Arts)

Field Trip!! We will be meeting in front of Downtown LCC @ 10:00, on Wednesday. Then walking from DT LCC to Oregon Art Supply, and then to MECCA. If you have afternoon classes at Building 2120, we will be back to in time for those.

*Update: We found some great items at MECCA! Next week we will reuse & repurpose the items we found to create gifts for our friends and family.

11/3/21: Painting Glass

Today we painted glass vases, and jars.

10/27/21: Fall Floral Mini Pumpkins

This video will show you basically how we created our cute little pumpkins. We didn’t paint ours, but that’s a fun idea to try.

https://www.youtube.com/watch?v=-aYbTJD9Re8&t=60s

10/20/21: No Sew Fleece Blankets & Gift Wrapping Hacks

The fleece blankets turned out great! But, we ran out of time and didn’t get to the gift wrap ideas. We will revisit the gift wrap hacks later in the term.

10/13/21: 3D Canvas / Mixed media (using chalk pastels, colored pencils, wood, wire, glue, artificial snow, matte spray to set pastels)

This was such a cool project! And, everyones turned out great!

More photos coming soon….

10/6/21: Glass Marble Jewelry

The video below demonstrates how to make the cracked effect on glass marbles & gems. If you choose to do this craft at home Please follow all safety guidelines discussed in the video.

9/29/21: Scrabble Tile Coasters

This was a very fun craft to make and share with friends, family, or keep for yourself. Lori found cork that came already cut to size with adhesive already on it, and letter tiles on Amazon.

9/22/21: Para-cord Lanyards

________________________________________________________ ———————————-Game Of Life /Spring 2021———————————–

6/16/21

Congratulations! You have been employed full time for a year 🙂 Time to get your last paycheck and head out to your vacation!

Update your budget sheet to reflect the changes for this month

Oh no! You need to move and your rent will increase by $500 a month. Your monthly budget doesn’t allow for that. What do you do?

Cutting Back on Spending

Are you happy with where your money is going?

If not, look at your habits. Sometimes we just buy things or go places out of habit without giving it a lot of thought. When money’s tight, it’s a great idea to look over your spending for small ways to trim costs. Tracking your spending will help you to be more aware of your spending habits – and changing a few habits can result in big savings.

There are 3 ways to save money on (almost) anything. Pick one expense out of your budget:_______Shoes, coffee, streaming service, lunch, movies, books__

Can you figure out a way to:

Do it less often_________________________________________________

Buy it cheaper? ________________________________________________ Or even cut it out altogether? __________________________________

Consider some of your habits and how they add up over time. The question is, what habits – eating out, music subscriptions, or ? – would you be willing to cut back on? If you miss whatever you cut out too much, then that’s not the expense to cut out. Move on and try something else.

|

Purchase or Habit |

How Often Monthly |

Monthly Cost x 12 = Yearly Cost |

||||||

|

Example: Eating Out = $20 |

4 times/month = $80 |

$80.00 x 12 = $960.00 |

||||||

| shoes | every three months $80 | 4 x 80=320 | ||||||

|

What’s your total? |

Monthly $ |

Yearly $ |

Increasing Your Income

Sometimes more money can come from turning a hobby into a second job, getting a tax refund, reducing the amount of taxes withheld, or selling stuff you don’t use anymore. Even small changes can add up. But it’s just as important to understand how decisions to cut costs to save money can affect your future financial security.

Dropping or Decreasing Benefit Contributions: When you look at your paycheck, what deductions do you see listed? Some deductions might be non-negotiable, like a pension plan, while other contributions might be scaled back even if temporarily. Check with

your human resources office to find out which payments are under your control.

Keep in Mind:

Health coverage: There are typically restrictions and enrollment periods surrounding health care plans and supplemental policies that may prevent or postpone your ability to cancel certain coverage. If you drop a policy and later want to re-enroll, you may be faced with issues around pre-existing conditions and waiting periods.

Retirement savings: Some pension programs are mandatory, but you might also have voluntary retirement contributions taken out of your paycheck. Cutting back on retirement savings can add more to your monthly budget now, but you’ll have less money when you’re older which could mean working longer or living on less later.

Life and disability insurance: Some policies are mandatory, while others could be cancelled. Dropping certain types of protections could leave you and your family vulnerable to economic disaster. Instead of dropping the coverage entirely, are there options to increase your deductible or waiting period? Just make sure you have the money to cover a larger deductible if something happens.

Taxes and Tax Credits: A drop in income might affect the amount of taxes you have withheld from your paycheck. You might also be eligible for tax credits, such as earned income, child tax credit, or homestead credit, when you file your taxes next year.

Keep in Mind:

Do the math: You don’t want to be in a position of having too little taxes withheld and then scramble for money next April to make a tax payment.

File taxes even if you don’t owe money: Tax credits can either be refundable, meaning they will add to your refund if you don’t owe any money, or non-refundable, meaning they will only credit you if you owe money. While deductions are subtracted from your income, tax credits are subtracted from your tax due. Which is better depends on your income level.

To find out more: Visit the Internal Revenue Website at: www.irs.gov.

Selling Assets: Selling items online or at a rummage sale can help you come up with cash to put toward your monthly bills. While this can be a good one-time source of cash to pay down debt, it doesn’t add to your monthly income to cover future debt payments.

Keep in Mind:

You could lose money: When selling, you typically won’t get as much money as you paid for an item. If you plan to replace the item when you get back on solid financial ground, this option could cost you more money in the long run.

Are you really willing to sell?: You might own some family heirlooms or items with sentimental value that would be too hard to part with.

Do you own it?: You might not be able to sell an item that is being used as collateral for a loan. Sometimes the creditor will give you permission to sell the item, such as an auto, in order to use the money to pay off the balance on the loan.

Withdrawing Retirement Savings: The Internal Revenue Service allows ―hardship withdrawals‖ from certain retirement plans under circumstances that present an immediate and heavy financial need, including preventing foreclosure or eviction. Your withdrawal is limited to the amount of money you paid in and does not include any employer match or interest income. A withdrawal is not considered necessary if you still have other options available to you, such as getting a bank loan or selling assets.

A hardship withdrawal is different from taking a loan out of your retirement account. Unless you’re purchasing a home, a loan must be repaid within 5 years with payments beginning immediately. On the other hand, a hardship withdrawal doesn’t need to be paid back. If you take out a loan and then leave the company before the loan is paid back, you must repay the loan right away or else pay taxes and penalties.

Keep in Mind:

- You could owe more taxes: Withdrawals are taxed as income, plus there’s a 10% penalty added on, so you need to figure this amount into how much savings you plan to withdraw. It’s extremely important to check with a tax professional about penalties and taxes due if you are considering cashing in a retirement policy. Find out more on the IRS website at: www.irs.gov.

- There are exceptions for withdrawals: A retirement plan is not required to offer hardship withdrawals. Your options for withdrawing savings also depend on the type of plan you have, such as a 401(k), 403(b), 457(b) or IRA.

- The long-term impact: A hardship withdrawal permanently lowers your retirement savings since the money can’t be paid back once it’s taken out. Also, you won’t be able to contribute to any retirement account for at least 6 months following a withdrawal.

- If it comes down to bankruptcy: Retirement savings are exempt from seizure by your creditors during a bankruptcy. Once you’ve spent the hardship withdrawal from your retirement savings, what other options do you have for keeping up with your bills? Borrowing from retirement savings may not be the best option if you end up filing for bankruptcy a few months later.

Increasing household resources

When’s there not enough money available to cover monthly bills, there are other ways to balance the family budget. If your income has dropped, you may be eligible for a number of programs that target individuals and families with lower incomes. Government and non- profit assistance programs can help bring in needed resources, such as housing, heating, or food payment assistance.

Most programs don’t use the poverty line as a cutoff point for eligibility, but instead many programs have eligibility criteria that are based on multiples of the poverty line. For instance, school meals are generally provided at no cost to children with family incomes below 130% of the poverty line, and school meals are at reduced cost to children with family income up to 185% of the poverty line.

The state of Wisconsin and the federal government offer many programs to help you find financial security. Check out access.wisconsin.gov or contact your county human services office to see if you qualify.

Dial 2-1-1

If you are having immediate trouble meeting your basic needs, call 211 for a local directory of all the government and non-profit programs, agencies, and organizations that seek to provide services to low-income individuals.

Step #5: Paying Bills

Using a monthly spending plan worksheet, work out your new income and monthly expenses, factoring in any new cuts you plan to put into place. It’s helpful to figure out what bills are priorities for you, for example, the mortgage or car payment. After you set aside enough money for priorities, then divide the rest of your income among the other bills. This will give you a picture of your current spending and how tight your budget is during the month.

If you find that money is tight and you’re worried you won’t be able to keep up with payments, take action right away. It may be a matter of moving a payment due date to later in the month, for example, to better match your paycheck. Or it might mean renegotiating a lower monthly payment. Not all creditors or credit card companies will be willing to negotiate with you, but if you’ve been a good customer, it increases your chances that they’ll work with you.

At the first sign that you will not be able to make a payment, do the following:

- Contact your creditors BEFORE they contact you. When you call creditors, you’ll need to work with someone—a supervisor, accounts manager, or ―loss mitigation‖ specialist—who can negotiate with you. Be prepared for busy signals or spending some time on hold since many others in similar situations may be calling too. If the creditor is local, make an appointment to meet with them in person.

- Make specific and realistic offers to creditors. A creditor does not have to accept a lower payment from you, but it never hurts to ask and explain your situation. Agreements may include lower payments over a longer period (with more interest added) or payment on interest alone for a set time period. Don’t make promises you can’t keep.

Follow up with a letter detailing the arrangements you agreed to with each creditor. In the letter, write down the terms of your agreement including amount and due date, the name of the person you talked to, and the date. Keep a copy of the letter for your records. Get agreements in writing and signed by the creditor before you send in payments.

Contact a credit counseling agency if you need help working with your creditors. These agencies charge a fee, and a debt repayment program may affect your credit rating. Beware of debt settlement agencies that might charge you high fees and not pay off your creditors. To find a reputable credit counselor near you, go to: www.debtadvice.org. For help with options to keep up with your mortgage, call 1-888-995-HOPE or go to: makinghomeaffordable.gov.

- Consider seeking legal advice if a creditor has filed a judgment against you to garnish your wages or repossess collateral, you may want to speak with an attorney before the court date. You have rights under the Consumer Protection Act.

- Don’t take on new debt. You may be tempted to use credit cards or a home equity loan to pay bills. Unless your situation turns around quickly, more debt can create bigger problems.

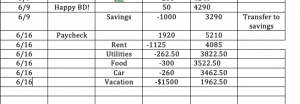

6/9/21

Pay day! but it’s also time to pay your bills and get your “surprise.” Update your budget

tracking sheet to reflect your income and expenses.

Your surprise income today will be HAPPY BIRTHDAY! everyone at the same time 🙂 $50

With a little research and budgeting, planning a trip can actually give you a sense of relief and control that makes the getaway much more fun. So, here are seven steps to plan a trip on a budget:

1. Plan your trip budget. $3,290 no more than $2,000

This is the most important step and will affect the rest of your trip-planning process. Determine how much you want to spend on everything from hotels and gas to souvenirs and meals. It doesn’t have to be a ton of money—there are many ways to plan an affordable vacation or staycation.

You can use my free Vacation Budget Worksheet to plan out each category. As you’re planning, if you decide something is too expensive, scale it back or cross it off the list.

2. Choose the top places you’d like to go.

On the surface, this may seem like the easiest (and most fun) part of your planning. But here are some questions you need to ask:

- Which destinations fit within my budget?

- Does my destination affect whether I plan it myself or hire a travel agent?

- Will I drive or fly?

Did you know a bunch of popular U.S. cities actually have a lot of free and super cheap things to do? Check out my list of the 10 cheapest places to travel.

3. Research flights and dates.

As you’re planning your trip, know that certain times of the year are cheaper to travel than others. Everyone knows flights will be more expensive around a holiday, but there are lots of other factors that determine how much you’ll pay for that flight or hotel. Do your research, play around with dates, and decide how many days you can afford to be there. I put my top 10 travel booking hacks in this video:

4. Look for deals.

You can find websites all over the internet that will help you score deals on hotels, amusement park tickets, airline travel and so on. Here are some great resources:

- Google Flights

- Groupon Getaways

- Tripadvisor

- Expedia

- Scott’s Cheap Flights

- Kayak

Make sure you look for bargains after you set the budget—for two reasons. First, once you know where you’re going and how much you want to spend, you’ll be able to look for specific savings. Second, it’s a big morale boost to see that you’re coming in under budget when you find a deal.

5. Start saving up.

Here’s where the rubber meets the road! By working and saving up the money now, you won’t have to deal with payments or credit card interest rates after you come home. Use your trip as motivation when you’re pulling a double shift or taking freelance work. Print out an image from your destination (like a beautiful beach or snowy mountain scene) or save it as your phone screen as a reminder of what you’re working toward.

6. Create your itinerary.

As you’re saving up for your trip, you can also start scheduling which days you’ll do what activities. What excursions, tours and sight-seeing will you do? What reservations do you need to make in advance? If you do a lot of running around one day, do you need to block off the next day for some rest and relaxation? I think it’s fun to go ahead and book some things in advance. I love knowing it’s paid for and checking it off my list. Use Yelp or Tripadvisor to research reviews and pricing to make sure you won’t blow your trip budget.

7. Go and enjoy your trip!

Nothing is worse than paying for a vacation for months after it’s over. But if you take these steps to plan and budget ahead of time, you’ll avoid that headache. Then, when you’re on your trip, live it up! Relax and enjoy.

These seven steps will ensure the bills for your trip don’t follow you home so you can leave the beach at the beach. The reason more people don’t plan this way is because they want the instant gratification. They want to enjoy now and worry about how to pay later. That leads to overspending, and it creates stress and regret.

My vacation

Where will you go?

How will you get there? Plane, train, bicycle

How will you get around when you are there? Car rental, public transportation

Where will you stay? Hotel, camping, air BnB

Will there be any costs to tourist sites? Entrance fees

What will you eat? Do you have a kitchen, it is inclusive, restaurants

How much will you budget for Souvenirs/Gifts?

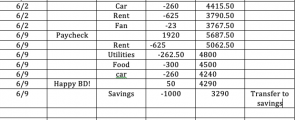

6/2/21

Pay day! but it’s also time to pay your bills and get your “surprise.” Update your budget

tracking sheet to reflect your income and expenses.

Your surprise cost today will be purchasing a fan or air conditioner. Do some research on how much that would cost.

Fans:

stand up fan $21, floor fan, window fans $23, ceiling fans, desk fan, air movers, tower fan, oscillating fan

Air Conditioners:

window air conditioner $170, portable air conditioner, central air conditioner

Now that you have your car, your pet and your apartment you can budget for the fun things in life. What are some of your wants?

driverless car, sun protection, clothes, kayak, fence, garden, ticket to Hawich, California, Iceland, Netherlands,

But vacations can be expensive.

With a little research and budgeting, planning a trip can actually give you a sense of relief and control that makes the getaway much more fun. So, here are seven steps to plan a trip on a budget:

1. Plan your trip budget.

This is the most important step and will affect the rest of your trip-planning process. Determine how much you want to spend on everything from hotels and gas to souvenirs and meals. It doesn’t have to be a ton of money—there are many ways to plan an affordable vacation or staycation.

You can use my free Vacation Budget Worksheet to plan out each category. As you’re planning, if you decide something is too expensive, scale it back or cross it off the list.

2. Choose the top places you’d like to go.

On the surface, this may seem like the easiest (and most fun) part of your planning. But here are some questions you need to ask:

- Which destinations fit within my budget?

- Does my destination affect whether I plan it myself or hire a travel agent?

- Will I drive or fly?

Did you know a bunch of popular U.S. cities actually have a lot of free and super cheap things to do? Check out my list of the 10 cheapest places to travel.

3. Research flights and dates.

As you’re planning your trip, know that certain times of the year are cheaper to travel than others. Everyone knows flights will be more expensive around a holiday, but there are lots of other factors that determine how much you’ll pay for that flight or hotel. Do your research, play around with dates, and decide how many days you can afford to be there. I put my top 10 travel booking hacks in this video:

4. Look for deals.

You can find websites all over the internet that will help you score deals on hotels, amusement park tickets, airline travel and so on. Here are some great resources:

- Google Flights

- Groupon Getaways

- Tripadvisor

- Expedia

- Scott’s Cheap Flights

- Kayak

Make sure you look for bargains after you set the budget—for two reasons. First, once you know where you’re going and how much you want to spend, you’ll be able to look for specific savings. Second, it’s a big morale boost to see that you’re coming in under budget when you find a deal.

5. Start saving up.

Here’s where the rubber meets the road! By working and saving up the money now, you won’t have to deal with payments or credit card interest rates after you come home. Use your trip as motivation when you’re pulling a double shift or taking freelance work. Print out an image from your destination (like a beautiful beach or snowy mountain scene) or save it as your phone screen as a reminder of what you’re working toward.

6. Create your itinerary.

As you’re saving up for your trip, you can also start scheduling which days you’ll do what activities. What excursions, tours and sight-seeing will you do? What reservations do you need to make in advance? If you do a lot of running around one day, do you need to block off the next day for some rest and relaxation? I think it’s fun to go ahead and book some things in advance. I love knowing it’s paid for and checking it off my list. Use Yelp or Tripadvisor to research reviews and pricing to make sure you won’t blow your trip budget.

7. Go and enjoy your trip!

Nothing is worse than paying for a vacation for months after it’s over. But if you take these steps to plan and budget ahead of time, you’ll avoid that headache. Then, when you’re on your trip, live it up! Relax and enjoy.

These seven steps will ensure the bills for your trip don’t follow you home so you can leave the beach at the beach. The reason more people don’t plan this way is because they want the instant gratification. They want to enjoy now and worry about how to pay later. That leads to overspending, and it creates stress and regret.

My vacation

Where will you go?

How will you get there? Plane, train, bicycle

How will you get around when you are there? Car rental, public transportation

Where will you stay? Hotel, camping, air BnB

Will there be any costs to tourist sites? Entrance fees

What will you eat? Do you have a kitchen, it is inclusive, restaurants

How much will you budget for Souvenirs/Gifts?

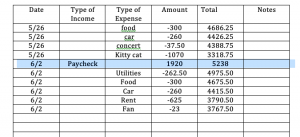

5/26/21

Pay day! but it’s also time to pay your bills and get your “surprise.” Update your budget tracking sheet to reflect your income and expenses.

The Annual Cost Of Pet Ownership

The Annual Cost Of Pet Ownership: Can You Afford A Furry Friend?

The first-year cost of pet ownership exceeds $1,000, according to the ASPCA. If you have the foresight and are considering bringing a furry friend into your home, you might want to ask: Can you afford to be a pet owner?

The costs of bringing an animal into your home go far beyond any initial adoption fee, which can vary from nothing at all to hundreds of dollars. Here is a breakdown of the average first year cost of pet ownership costs for one medium dog or one cat, according to the ASPCA.

One-time pet expenses:

Spaying or Neutering: Dog: $200 / Cat: $145

Initial Medical Exam: Dog: $70 / Cat: $130

Collar or Leash: Dog: $30 / Cat: $10

Litter Box: Cat: $25

Scratching Post: Cat: $15

Crate: Dog: $95

Carrying Crate: Dog: $60 / Cat: $40

Training: Dog: $110

Total One-time Costs: Dog: $565 / Cat: $365

Annual pet expenses

Food: Dog: $120/ Cat: $145

Annual Medical Exams: Dog: $235 / Cat: $130

Litter: Cat: $200

Toys and Treats: Dog: $55 / Cat: $25

License: Dog: $15

Miscellaneous: Dog: $45 / Cat: $30

Total Annual Costs without insurance: Dog $470/ Cat $530

Pet Health Insurance: Dog: $225 / Cat: $175

Total Annual Costs with insurance: Dog: $695 / Cat: $705

According to this report, the total first-year cost of owning a dog is $1,270 and for a cat it’s $1,070.

Depending on the food you buy and your actual medical expenses, the costs could be much higher. If you rent an apartment, expect to pay a sometimes no refundable pet deposit or cleaning fee, if your landlord allows animals at all.

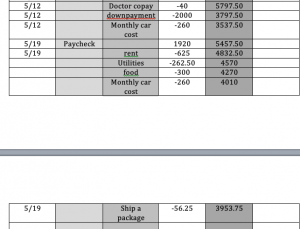

5/19/21

Pay day! but it’s also time to pay your bills and get your “surprise.” Update your budget tracking sheet to reflect your income and expenses.

Today your surprise cost will be mailing a package that weighs 12 lbs and is going to NYC zip code 11432 and is 12x18x12. Go to the site below and see how much it will cost.

https://postcalc.usps.com/Calculator

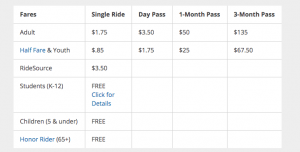

We will continue to pick the car or transportation you will be using.

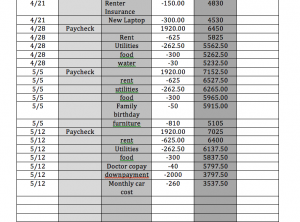

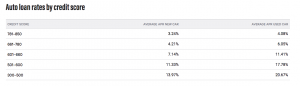

5/12/21

Pay day! but it’s also time to pay your bills and get your “surprise.” Update your budget tracking sheet to reflect your income and expenses.

Our next step is deciding what transportation you will use. This will depend on where you live and other factors such as if you want to drive.

Time to Buy Your Car!

Your insurance cost will be $110 per month

How much money are you willing to use as a down payment? _____$2000______ 5797.50

In the Google search bar type in “car payment calculator”

You will see a box that you can enter information into

Change the Interest rate to 5%

Enter various loan amounts to find out what your monthly payments will be. Make sure you subtract the amount you will be using as a down payment.

Decide what you are willing to spend but make sure you look at the total monthly cost:

Monthly car payment

+ $110

Total monthly cost

- Go to https://eugene.craigslist.org/

- Under “For Sale” click on cars + trucks

- Choose:

ALL CARS & TRUCKS

(dealer + by-owner)

One the left fill in your maximum price you will be willing to spend on a car.

You can also fill in the make and model you want and other search filters.

Decide what car you will buy, how much you will put as a down payment and your monthly cost.

The car/vehicle I will purchase is:

Make ___________________

Model __________________

Year ____________________

Purchase Price __________10000_________

Down payment ________2000___________

Monthly cost (from above)_____270_______________

5/5/21

Pay day! but it’s also time to pay your bills and get your “surprise.” Update your budget tracking sheet to reflect your income and expenses.

Each of you will assigned a few items to shop for. Find out the average cost for new and used basic furniture and accessories.

Our next step is deciding what transportation you will use. This will depend on where you live and other factors such as if you want to drive.

4/28/21

Pay day! but it’s also time to pay your bills and get your “surprise.” Update your budget tracking sheet to reflect your income and expenses.

You have been living in an empty apartment for the past month! Time to furnish it. Let’s go furniture shopping 🙂

First-Apartment-Checklist-Download

Open up the document above and decide which items you absolutely need to purchase. Then go online and see how much these items would cost new and used. We will discuss how to be creative on furnishing your apartment.

| Must have Item | Cost new | Cost used |

| twin Bed Silas | $399 | $158 |

| Dresser Silas | $155 | $110 |

| twin Sheets Abby | $9.00 | — |

| Night stand Abby | $69 | $5 |

| Couch Emma | 300 | $80 |

| Coffee Table Emma | $30 | $75 |

| Television 32″ grace | $269 | $150 |

| 4 Towels grace | $10 | — |

| Dishware service for 4 Izzy | $40 | $9.00 |

| Pots and Pans Izzy | $40 | $19 |

| Microwave audric | $35 | $10 |

| Cleaning supplies set Eman | $50 | —- |

| Basic tool set Eman | $60 | |

| First aid kit John | $35 | — |

| Fire Extinguishers John | $30 | — |

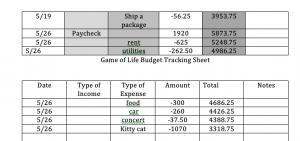

4/21/21

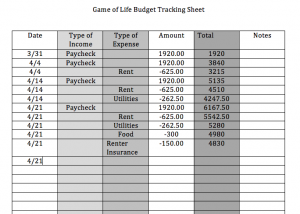

Let’s start tracking your budget so you know how much money you have! Download the link below to get a blank budget tracking sheet. Below I have added what you have earned and your expenses so far.

Game of Life Budget Tracking Sheet

There are always surprise expenses that you need extra money to budget for. Here it comes! Pick a number 1-10 I will let you know which surprise income or expense you will receive.

Let’s eat!

The estimated average food cost per month for 1 person for both single males and single females in various age groups. For all categories combined, the US average food cost per month for 1 person is about $301.00.

How to reduce Food Costs

1. Cook at home

It does take more time, but cooking and eating at home can save you loads of money in the long run. Consider that the actual cost of food for a restaurant meal is less than a third of what you pay for it. The rest of the money you spend at a restaurant goes to other costs like labor and overhead. If you cook at home, you only pay the food cost, and pocket the rest.

2. Stock up on staples

Already buying lots of beans, you say? Stop hauling home heavy cans, and buy dried ones that you soak yourself. Load up on cereals too, like rice, cornmeal and oatmeal. Eggs, peanut butter and bread can also go a long way toward feeding a hungry family on a tight budget.

3. Swap pricey proteins or goods for cheaper ones

Ground beef costs less per pound than steaks. And poultry tends to be cheaper than other types of meat. Save the scallops for really special occasions, though canned fish and seafood can be a good, cheap and healthy alternative.

If you’re trying to chip away at your food budget, and you’re spending a ton on nonalcoholic beverages, like the average American family, we have two words for you: tap water. If you live somewhere where the water tastes terrible, try squeezing in a lemon or boiling it into tea. Buying coffee at chains like Starbucks or Dunkin Donuts everyday, while convenient, can quickly total about $5 – $7k over a decade, based on our calculations. Consider investing in a Keurig, Nespresso, or even a regular drip coffee maker to chip away at your coffee habit.

Food and drinks are necessary for life, but a few small tweaks can help you spend less on them.

Renter Insurance $150 per year one time cost

https://www.youtube.com/watch?v=llXiZrgAQ_A&t=13s

- When renting a home, you’ll need an insurance policy to cover your personal belongings known as renter’s insurance.

- Landlords have property insurance but those policies cover only the building, not your personal items within.

- The majority of renters don’t purchase renter’s insurance, either because they don’t think it is necessary or believe they are covered under the landlord’s policy.

- Reasons to purchase renter’s insurance include its affordability, the coverage of losses to personal property, it might be required, it provides liability coverage, it covers your belongings when you travel, and it may cover additional expenses.

4/14/21

Congratulations on moving into your new apartment! It’s important to track your income and spending so that you can make sure you pay your bills on time and have enough money. There are many ways to track you money and many people use technology to help them.

Your homework:

Figure out if you want to use an app to track your income and expenses. and learn how to use it.

Figure out how much your share of the utilities are where you are “living”

How Use the App “Pocket Expense”

To get started:

- Find the blue app listed “expense”

- Open it, swipe twice to the left till you see a sign in page

- Click the small grey “sign up” (at the bottom)

- For email type your first name and then @4j.lane.edu ie John@4j.lane.edu

- Your password will be – life

- Tap “go” on your keyboard

- To sign out, tap the gear on the very bottom left of the page, swipe up and tap the red log out at the bottom

To add income:

- Pick the date you earned the income on the calendar and tap on it

- Tap the blue plus sign on the bottom left

- For Payee, type in where your income came from ie paycheck, gift etc

- Tap the plus sign

- Tap the number to the right and a keypad will show up

- Type in the amount

- Click on “category” and pick the category that matches or create your own

- Press save on top right

To deduct expenses:

- Pick the date you spent the money on the calendar and tap on it

- Tap the blue plus sign on the bottom left

- For Payee, type in who the money went to ie EWEB etc

- Tap the negative sign

- Tap the number to the right and a keypad will show up

- Type in the amount

- Click on “category” and pick the category that matches or create your own

- Press save on top right

To pay a bill or reoccurring expense

- Click on the green bills icon on the toolbar on the bottom left

- Click the blue plus sign on the top right

- Type in the name of the person you are paying

- Tap on the amount and add the amount you are paying

- Add a payee name or category if needed

- Tap the date and pick when to pay the bill

- Tap the “never” on the “Repeat” line and pick how often to pay from the list

- In this game you will pick weekly since 1 week = 1 month

4/7/21

- If you missed the first class, please make sure to finish the activities from the first day.

- We will finish up the questions 1-4 about poverty below.

- Today you will find an apartment and start paying rent

You have a job, now it’s time to find an apartment!

Your monthly salary is $1,920.00

The experts recommend that you pay no more than 1/3rd of your salary in rent.

$1920.00 divided by 3 = $640 maximum monthly rent

You can choose to have roommates. The rent is less expensive if you share, but you also have more risk if they can’t pay the rent. You also have to share responsibilities with upkeep and get along with them.

If the rent for a 2 bedroom is $1000, your share would be $500,

if you rent a 4 bedroom for $1600 your rent is $400.

Get a computer or ipad and look through any of the following websites and find an apartment/house you want to rent.

https://eugene.craigslist.org/search/apa

http://www.zillow.com/eugene-or/apartments/

http://www.apartments.com/eugene-or/

You will be recording you monthly cost using this worksheet:

Name______Joe Shmo_________________

I work as a ____dishwasher______40 hours a week.

My monthly salary is $1920.00____

- Where do you live, with whom and what type of housing?

___I will live in a triplet near campus_________________________

- My monthly rent is $__625.00_____

- My monthly utilities are:

Electricity $50

Turning light off after you leave, unplugging appliances, turning off power strips when not in use, turn off tv if you are not watching, change the of temperature your fridge, if you have baseboard heating turn on a sweater, use a fan in the summer, hang your clothes to dry, use cold water

Water $30

taking shorter showers, turning off sink when not directly using it, limit watering outside, collect rain water, flush only when needed, low flow faucet and toilets, using a tub when dishwashing,

Garbage $17.50

Lane APEX, sanipac, recycle more and create less waste, get every other week pick up, take it to the dump

Heating/Cooling $50

you can get your bill to be consistent by contacting utility, insulate,

Internet $50/Cable $65

Subscriptions

Phone $50

Total 262.50

- Monthly Food Costs $___________________________

- One time cost of Renter Insurance $150 year

- My monthly transportation

Car

Bike

Bus

The transportation I will use is: ____________________________________________________________________________________________________________________________

One time cost $ _____________________________

Cost per month $____________________________

- My Vacation. I will travel to_____________________________________________________ and do_____________________________________________________.

Total one time Cost $______________________________

- My Pet. I will get _____________________________________________.

Cost $____________________________________

Pet insurance yearly Cost $____________________________________

- The furniture I will buy is ____________________________________________________________________________________________________________________________.

One time Cost $_____________________________________

3/29/21

Welcome to the GAME OF LIFE!

Here is a link to the worksheet if you want to print it out

In this seminar we will practice keeping your spending below your earning so that you do not run out of money. You will simulate independence by getting an income, expenses and unexpected costs. You will be keeping track of your income and expenses using electronic software or written ledgers.

Congratulations! You were recently hired in a 40 hour per week entry level position earning minimum wage. What is your job? Fast food, dishwashing, stocking shelves at grocery, customer service, telemarketing, bar back, bussing tables, gas station, cashier, convenience store, janitor entry level, hostess at restaurant, greeters,

What is the current minimum wage? _____$12.00 per hour__________

https://www.oregon.gov/boli/workers/pages/minimum-wage.aspx

Multiply the minimum wage by the hours you will work a week

Minimum wage = $ 12.00

Hours per week = x__40_____

Money earned each week= $480.00

Money earned each week= $480.00

Weeks per month= x____4_

Money earned each month= $1920.00

Money earned each month= $1920.00

Months per year= x___12___

Annual Income= $ 23,040

Time moves faster in this seminar so 1 week = 1 month

You will also earn 8 days of sick leave per year. Just like in real life, if you miss a seminar due to illness you are still responsible for paying the bills and you might lose some pay (depends on how much sick leave you have). One class absence = 2 days sick. Just like real life you can transfer money electronically if you aren’t present to avoid late fees!

The table below is the federal poverty income guidelines in order to be eligible for money benefits.

| PERSONS IN FAMILY/HOUSEHOLD | POVERTY GUIDELINE |

|---|---|

| For families/households with more than 8 persons, add $4,540 for each additional person. | |

| 1 | $12,880 $23.040 |

| 2 | $17,420 |

| 3 | $21,960 |

| 4 | $26,500 |

| 5 | $31,040 |

| 6 | $35,580 |

| 7 | $40,120 |

| 8 | $44,660 |

- If you are single with no children, is your annual income below the poverty line?

No, I make $23,040

- If you are single with 3 children Is your annual income below the poverty line?

Yes, that would mean 4 in a household and the guideline is $26,500 and I make below that

- If you are married and your spouse makes $20,000 a year how many children would you need to have to be considered below the poverty line?

23,040 + 20,000 = $43,040 combined income

household of 8 guidelines are 44,660, 2 adults, 6 children

- If you are single with no children and earned SSI at $794.00 a month are you considered poor?

$794.00 x 12 = $9528

Lets play the Game of Life online:

http://www.searchamateur.com/Play-Free-Online-Games/Game-of-Life.htm